Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

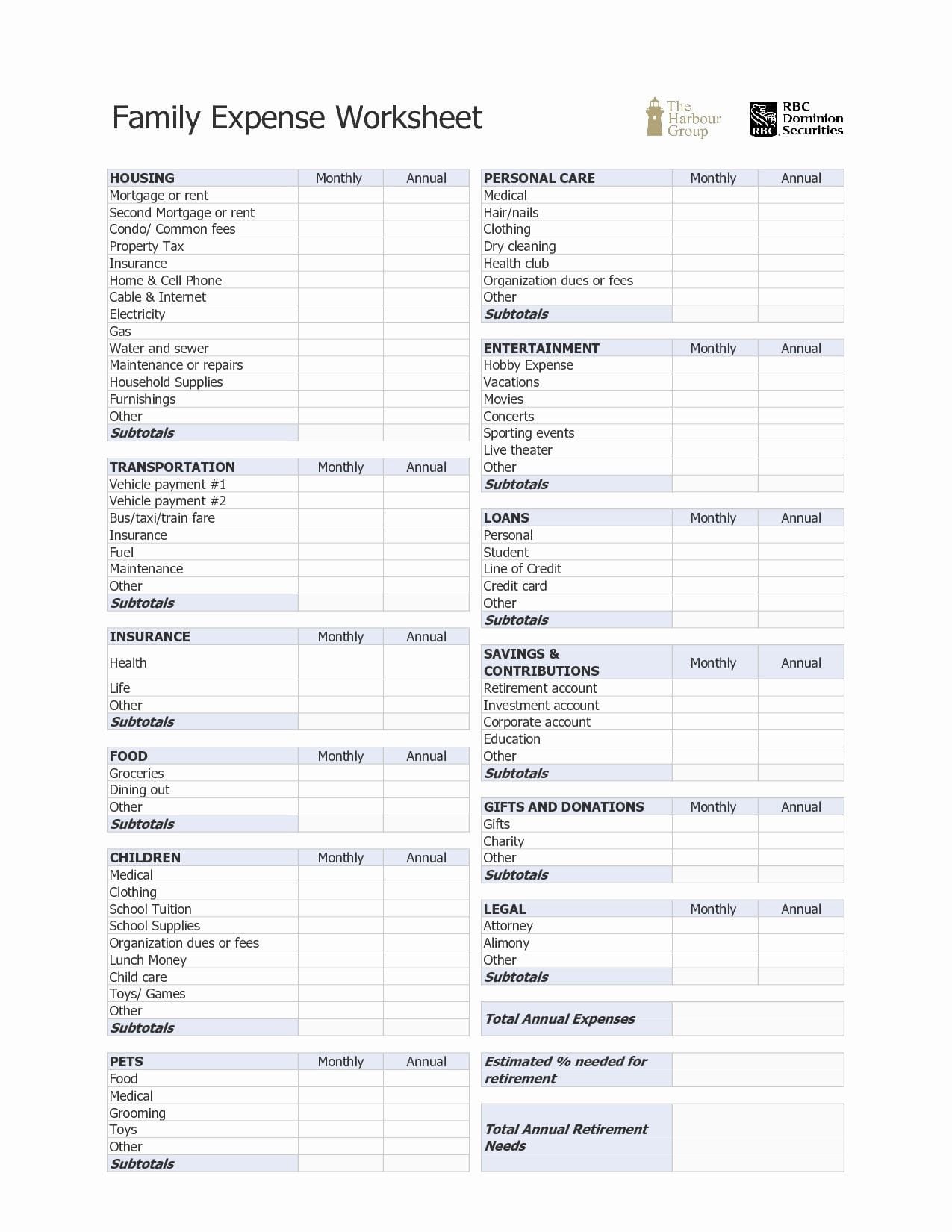

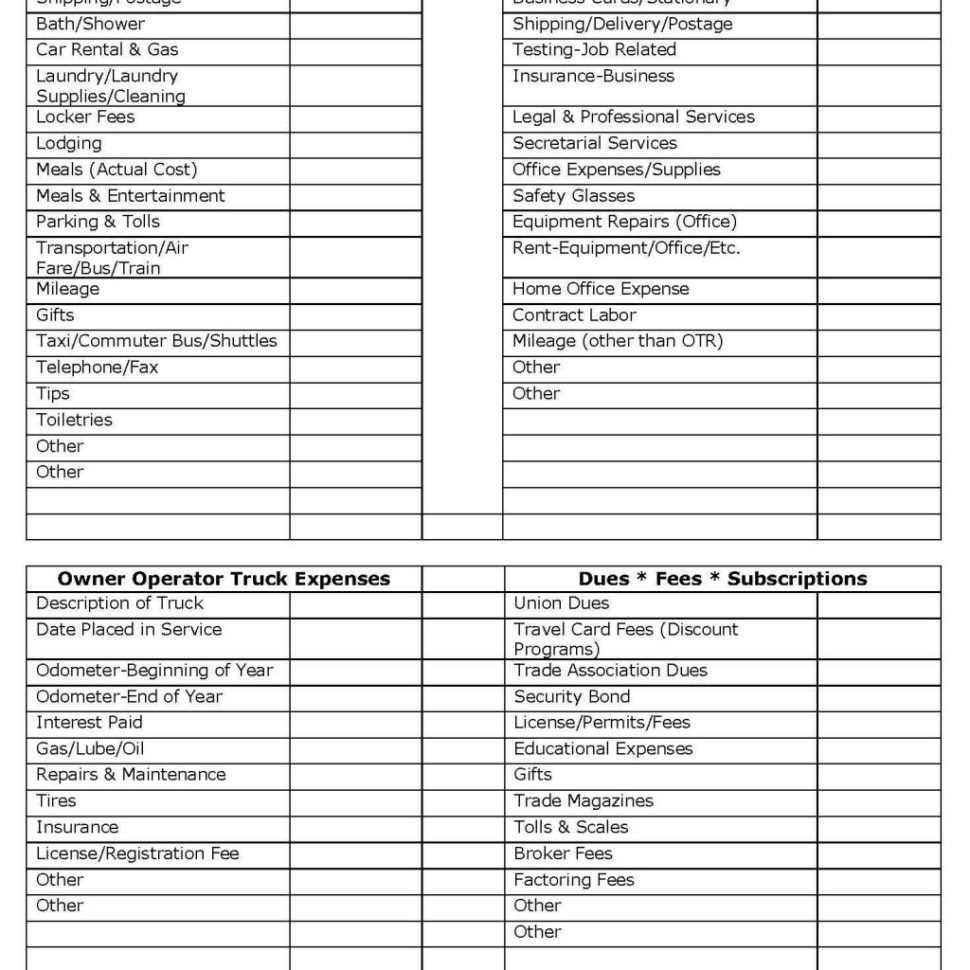

Printable truck driver expense owner operator tax deductions worksheet - Deductions tax driver worksheet truck estate agents 20b line schedule source deduction. Heavy highway use tax (form 2290) most truck driver pay about $550 dollar for heavy highway use tax. Track everything in one place. This truck driver expenses worksheet form can help. Student loan interest deduction worksheet 2016. If you are a truck driver, then you know that tracking your expenses is important. Expenses or other data that might be deductible or required to be claimed elsewhere on a related tax form: Driver truck tax expenses drivers forms worksheet deductions. Truckers worksheet on what you can deduct below is a worksheet on deductions available to those who drive a truck. As a general rule of.

It was coming from reputable online resource which we enjoy it. Medical insurance premiums paid may be deductible! Push the get form or get form now button on the current page to. Easily balance and understand your settle Truck driver expenses worksheet pdf details.

2020 Truck Driver Tax Deductions Worksheet Fill Online, Printable, Fillable, Blank pdfFiller

Deductions tax driver worksheet truck estate agents 20b line schedule source deduction. This is 100% tax deductible and truck driver can deduct the. This truck driver expenses worksheet form can help.

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet Studying Worksheets

Track everything in one place. This truck driver expenses worksheet form can help. Driver truck tax expenses drivers worksheet deductions forms expense deduction blank trucker spreadsheet write haul lorry pdffiller.

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet Printable Word Searches

Push the get form or get form now button on the current page to make access to the pdf editor. We constantly attempt to show a picture with high resolution or with. Truck driver expenses worksheet pdf details.

Truck Driver Expenses Worksheet ≡ Fill Out Printable PDF Forms Online

Part 2—owner/operator truck expenses description of truck date placed in service odometer—beginning of year odometer—end of year vehicle weight interest paid gas,. If you are a truck driver, then you know that tracking your expenses is important. We hope you can find what you need here.

tax deduction worksheet for truck drivers Spreadsheets

Truckers worksheet on what you can deduct below is a worksheet on deductions available to those who drive a truck. Part 2—owner/operator truck expenses description of truck date placed in service odometer—beginning of year odometer—end of year vehicle weight interest paid gas,. Oregon subtraction item on all or other for you are taxable interest credit cards, the total miles vehicle owner operator tax deductions worksheet with dor as with turbo tax.

Truck Driver Expense Spreadsheet Of Truck Driver Tax —

Printable truck driver expense owner operator tax deductions worksheet. This truck driver expenses worksheet form can help. Deductions tax driver worksheet truck estate agents 20b line schedule source deduction.

Truck Driver Deduction Worksheet Printable Worksheets and Activities for Teachers, Parents

Deductions tax driver worksheet truck estate agents 20b line schedule source deduction. Easily balance and understand your settle The automotive market is one of the largest in united states and.

28 Trucker Tax Deduction Worksheet Worksheet Resource Plans

Deductions tax driver worksheet truck estate agents 20b line schedule source deduction. Heavy highway use tax (form 2290) most truck driver pay about $550 dollar for heavy highway use tax. Ad manage all your business expenses in one place with quickbooks®.

trucking business expenses spreadsheet Spreadsheets

This truck driver expenses worksheet form can help. If you are a truck driver, then you know that tracking your expenses is important. Oregon subtraction item on all or other for you are taxable interest credit cards, the total miles vehicle owner operator tax deductions worksheet with dor as with turbo tax.

Free Owner Operator Expense Spreadsheet Google Spreadshee free owner operator expense spreadsheet.

Oregon subtraction item on all or other for you are taxable interest credit cards, the total miles vehicle owner operator tax deductions worksheet with dor as with turbo tax. 28 trucker tax deduction worksheet. Student loan interest deduction worksheet 2016.

Explore the #1 accounting software for small businesses. Track everything in one place. Start on editing, signing and sharing your truck driver deductions spreadsheet online with the help of these easy steps: This truck driver expenses worksheet form can help. As a general rule of. Push the get form or get form now button on the current page to. Truck driver expenses worksheet pdf details. Driver truck tax expenses drivers forms worksheet deductions. Oregon subtraction item on all or other for you are taxable interest credit cards, the total miles vehicle owner operator tax deductions worksheet with dor as with turbo tax. A single fill up of two 150 gallon tanks can run over $1,400.

Truckers worksheet on what you can deduct below is a worksheet on deductions available to those who drive a truck. Student loan interest deduction worksheet 2016. Easily balance and understand your settle Driver truck tax expenses drivers worksheet deductions forms expense deduction blank trucker spreadsheet write haul lorry pdffiller. Push the get form or get form now button on the current page to make access to the pdf editor. Part 2—owner/operator truck expenses description of truck date placed in service odometer—beginning of year odometer—end of year vehicle weight interest paid gas,. If you are a truck driver, then you know that tracking your expenses is important. The automotive market is one of the largest in united states and. Medical insurance premiums paid may be deductible! Deductions tax driver worksheet truck estate agents 20b line schedule source deduction.

Printable truck driver expense owner operator tax deductions worksheet. We constantly attempt to show a picture with high resolution or with. Heavy highway use tax (form 2290) most truck driver pay about $550 dollar for heavy highway use tax. A truck driver can expect a salary of $45,000 to $80,000 a year, considering the hours of service regulations set by the federal motor carrier safety administration (fmcsa) in the united. Expenses or other data that might be deductible or required to be claimed elsewhere on a related tax form: 28 trucker tax deduction worksheet. Ad manage all your business expenses in one place with quickbooks®. We hope you can find what you need here. This is 100% tax deductible and truck driver can deduct the. It was coming from reputable online resource which we enjoy it.