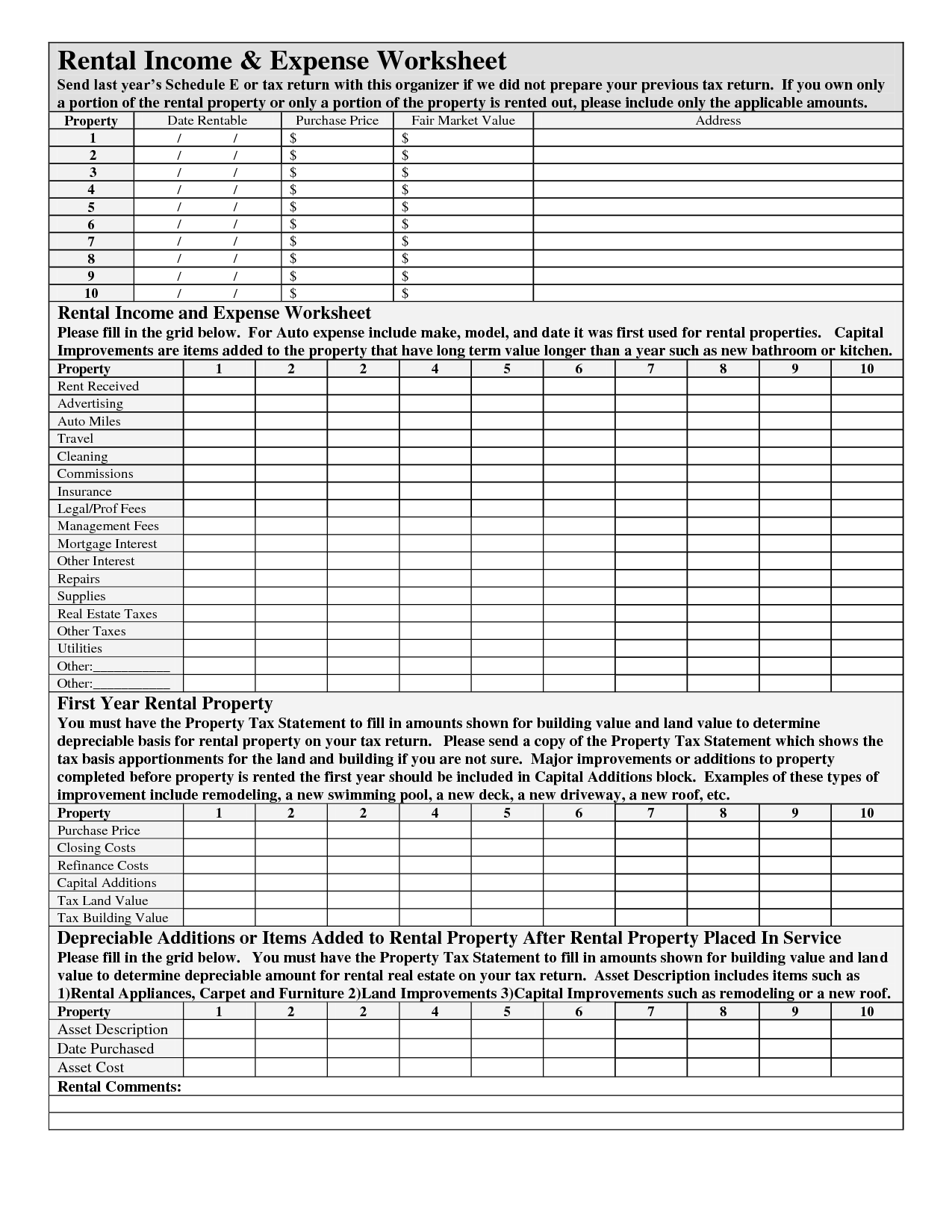

Printable Rental Income And Expense Worksheet

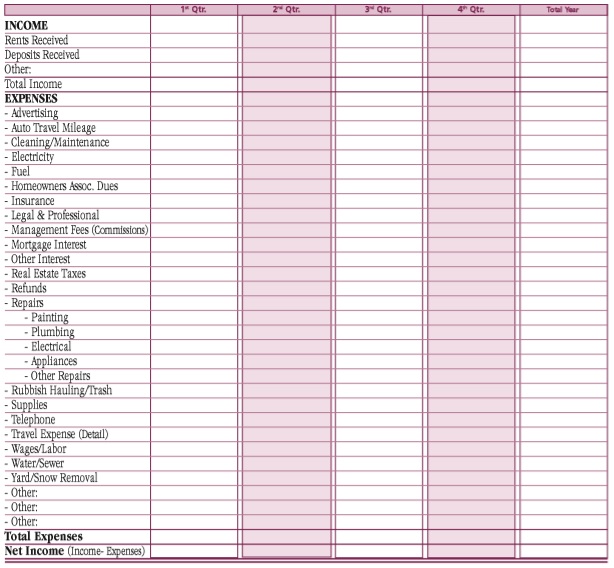

Printable rental income and expense worksheet - (364 kb) download rental property analysis spreadsheet details file format excel (xls,. The worksheet on the reverse side should help you. Phil can deduct $270 ($2,700 × 10%) from rental income. And the expenses portion is formatted for two hundred (200) discrete expense categories. Phil can allocate 10% of the. However, the income portion is formatted for up to fifty (50) different income categories. Check out our rental income and expense google sheets selection for the very best in unique or custom, handmade pieces from our shops. Take a peek on our rental income and expense worksheet. Wait until rental income and expense worksheet pdf. Can be used to keep up with monthly.

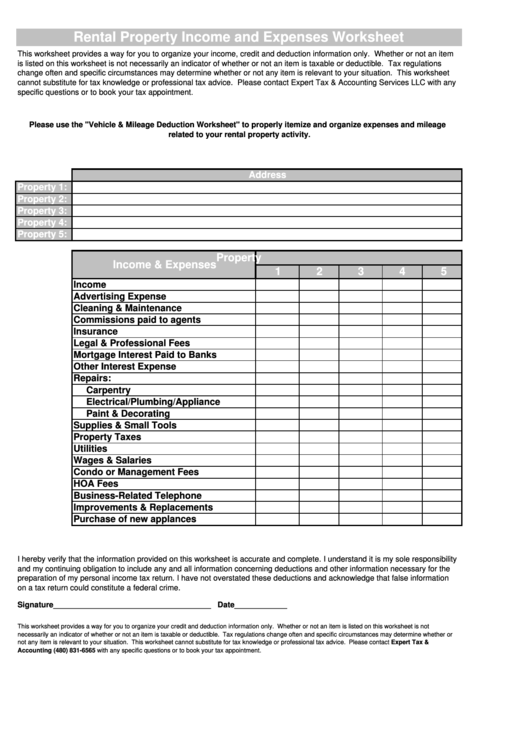

This digital bundle includes rental income tracker, rental expense tracker, and mileage logs for accurate tracking of miles driven to rental properties. The worksheet on the reverse side should help you. How to edit and sign rental income and expense worksheet pdf online. This rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. This landlords rental income and expenses tracking spreadsheet should be your choice to tidy up your financial transactions record.

Rental And Expense Worksheet Pdf Fill Online, Printable, Fillable, Blank pdfFiller

In the beginning, look for the “get form” button and press it. However, the income portion is formatted for up to fifty (50) different income categories. Wait until rental income and expense worksheet pdf.

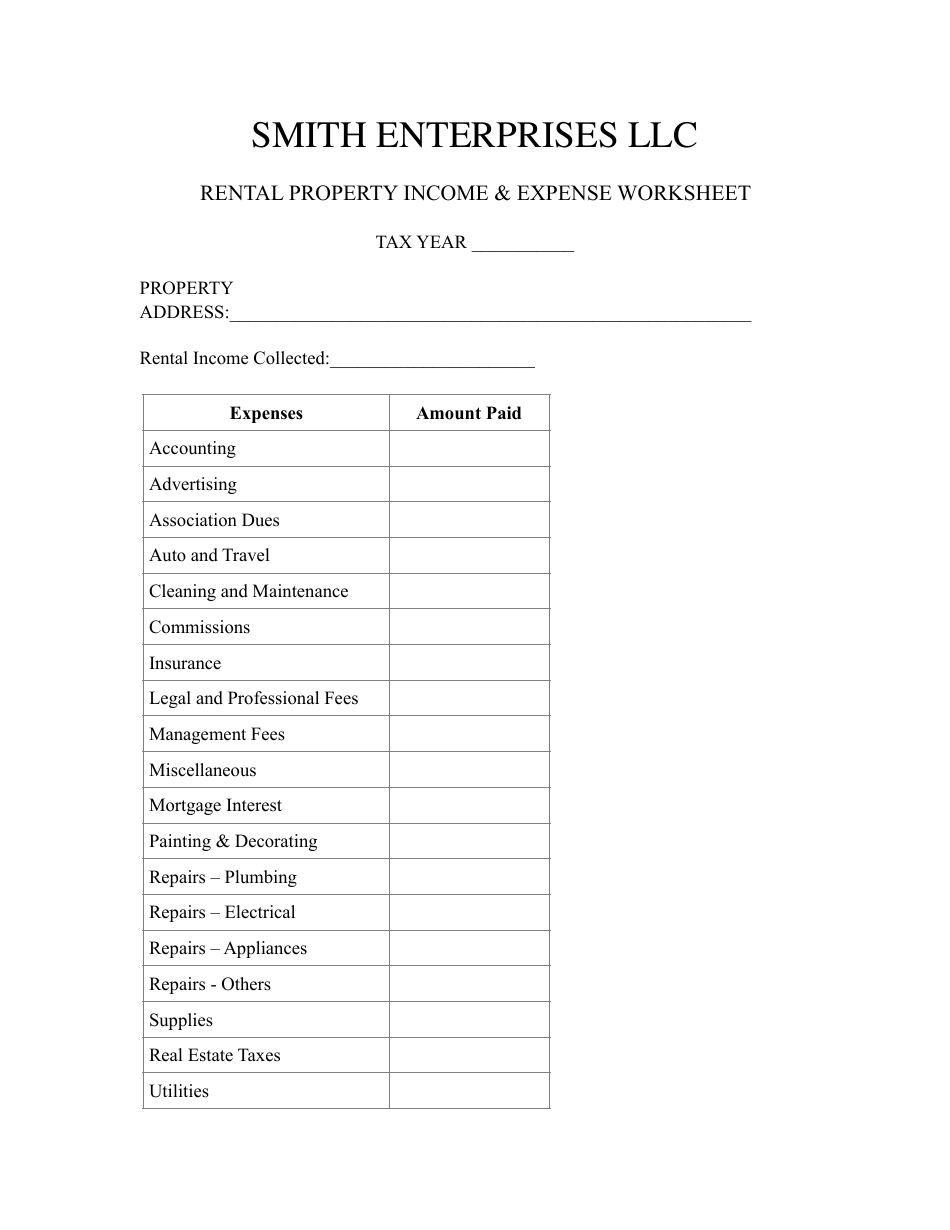

Rental Property & Expense Worksheet Template Smith Enterprises Download Printable PDF

Rental property income and expense worksheet download now “] truckers income and expense worksheet download now day care income and expense worksheet download. (364 kb) download rental property analysis spreadsheet details file format excel (xls,. Phil can deduct $270 ($2,700 × 10%) from rental income.

Rental And Expense Spreadsheet Template 1 Printable Spreadshee rental property expenses

Phil can allocate 10% of the home s expenses to the rental. Gross monthly rental income, operating expenses, net operating income, and pretax net income. Wait until rental income and expense worksheet pdf.

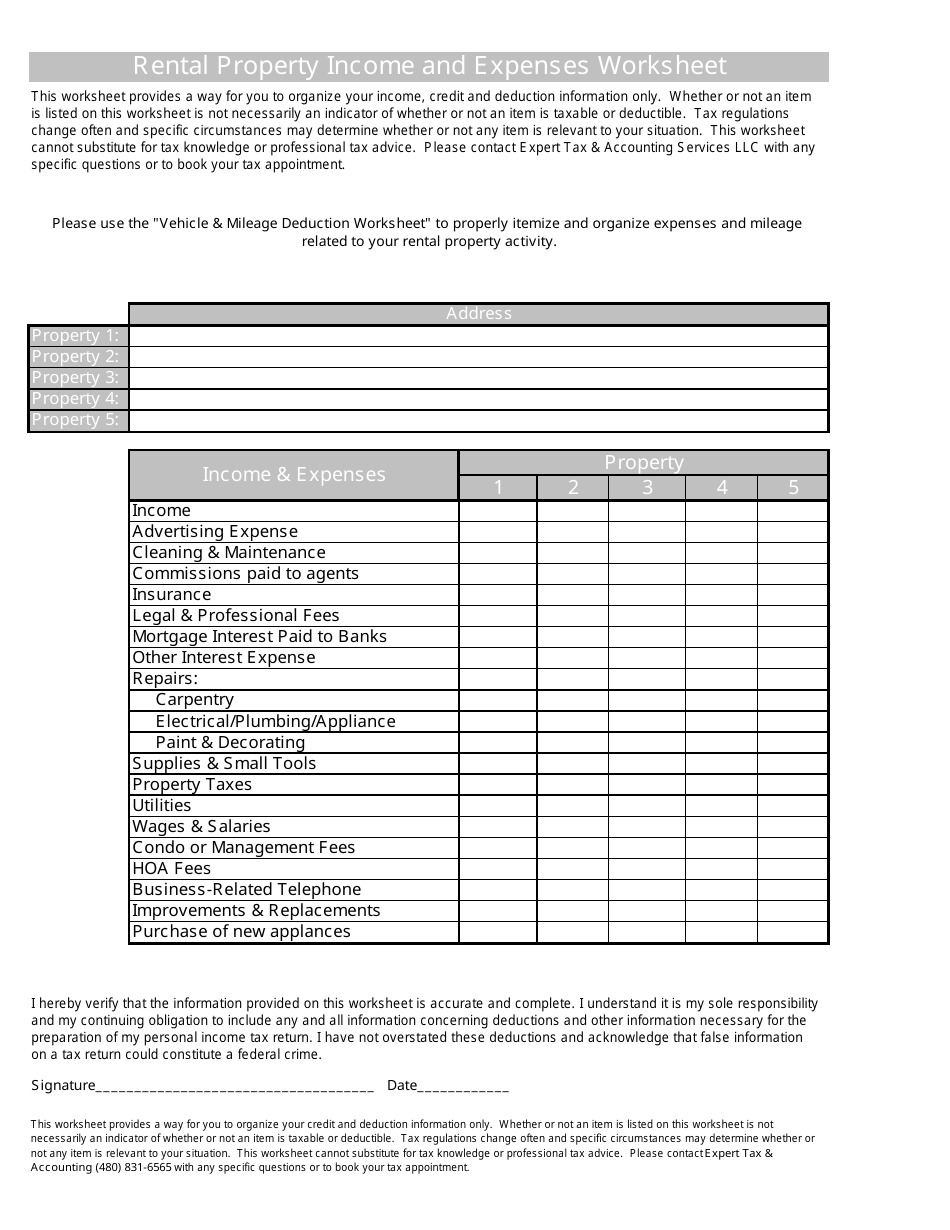

Rental Property and Expenses Worksheet Expert Tax & Accounting Services Llc Download

Rental property excel spreadsheet free details file format excel (xls, xlsx) size: This digital bundle includes rental income tracker, rental expense tracker, and mileage logs for accurate tracking of miles driven to rental properties. The worksheet on the reverse side should help you.

Rental And Expense Worksheet printable pdf download

Check out our rental income and expense google sheets selection for the very best in unique or custom, handmade pieces from our shops. This rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. You can fill it with your tenant as well.

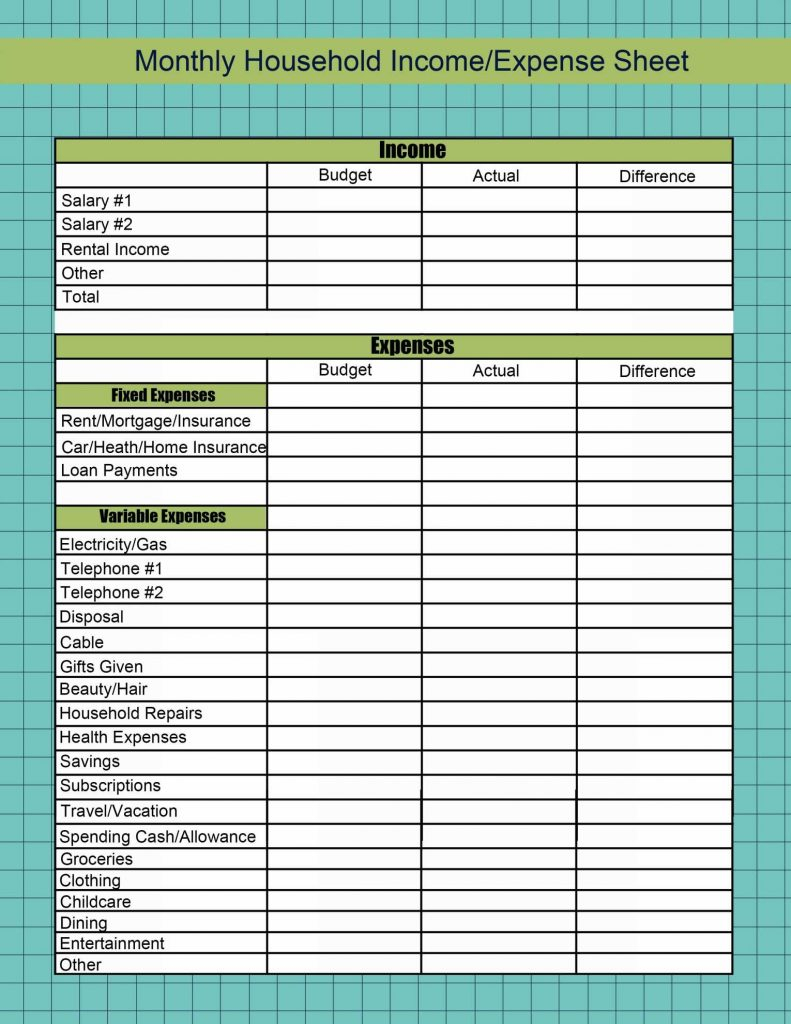

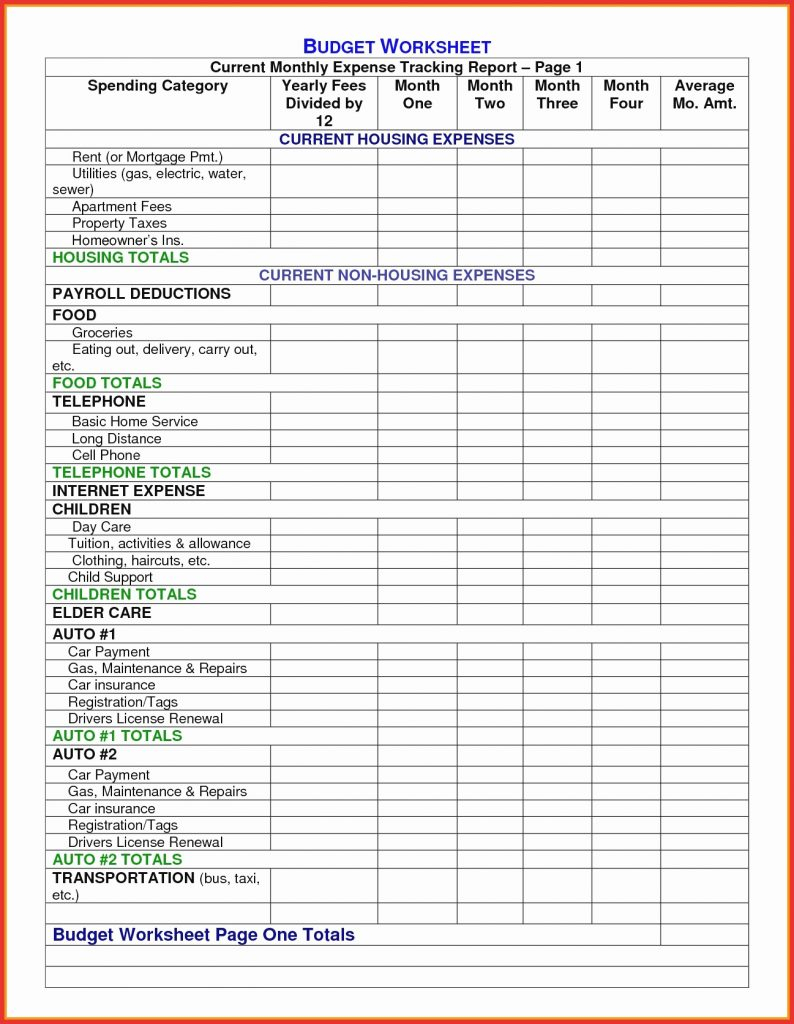

13 Best Images of Monthly Expense Worksheet Template and Expense Statement

Rental property income and expense worksheet download now “] truckers income and expense worksheet download now day care income and expense worksheet download. Gross monthly rental income, operating expenses, net operating income, and pretax net income. And the expenses portion is formatted for two hundred (200) discrete expense categories.

Rental And Expense Spreadsheet Template —

(364 kb) download rental property analysis spreadsheet details file format excel (xls,. The best way to modify rental income and expense worksheet pdf in pdf format online handling documents with our comprehensive and intuitive pdf editor is easy. This digital bundle includes rental income tracker, rental expense tracker, and mileage logs for accurate tracking of miles driven to rental properties.

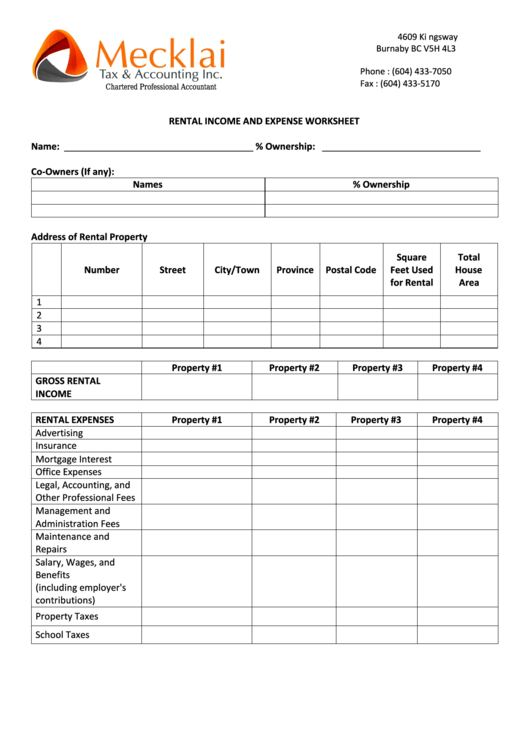

5+ Free Rental Property Expenses Spreadsheets Excel TMP

This rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. Wait until rental income and expense worksheet pdf. There are 4 main sections of information on a rental property income statement:

Rental Property And Expenses Worksheet printable pdf download

The total utility bills for the year are $2,700. This rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. Can be used to keep up with monthly.

Free Rental Property And Expenses Worksheet Commercial Real Estate Budget Template Excel

Rental property excel spreadsheet free details file format excel (xls, xlsx) size: The worksheet on the reverse side should help you. There are 4 main sections of information on a rental property income statement:

(364 kb) download rental property analysis spreadsheet details file format excel (xls,. Wait until rental income and expense worksheet pdf. Phil can allocate 10% of the home s expenses to the rental. Check out our rental income and expense google sheets selection for the very best in unique or custom, handmade pieces from our shops. How to edit and sign rental income and expense worksheet pdf online. Gross monthly rental income, operating expenses, net operating income, and pretax net income. In the beginning, look for the “get form” button and press it. The best way to modify rental income and expense worksheet pdf in pdf format online handling documents with our comprehensive and intuitive pdf editor is easy. There are 4 main sections of information on a rental property income statement: Take a peek on our rental income and expense worksheet.

The total utility bills for the year are $2,700. You can fill it with your tenant as well. And the expenses portion is formatted for two hundred (200) discrete expense categories. Can be used to keep up with monthly. This rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. Phil can deduct $270 ($2,700 × 10%) from rental income. This digital bundle includes rental income tracker, rental expense tracker, and mileage logs for accurate tracking of miles driven to rental properties. Rental property income and expense worksheet download now “] truckers income and expense worksheet download now day care income and expense worksheet download. However, the income portion is formatted for up to fifty (50) different income categories. The worksheet on the reverse side should help you.

Phil can allocate 10% of the. Rental property excel spreadsheet free details file format excel (xls, xlsx) size: This landlords rental income and expenses tracking spreadsheet should be your choice to tidy up your financial transactions record. The worksheet on the reverse side should help you. Home income and expense spreadsheet throughout business monthly.