Fsa Eligible Expenses 2020 Printable

Fsa eligible expenses 2020 printable - Includes various items that assist individuals in performing activities of daily living. You can use your fsa funds to pay for a variety of expenses for you, your spouse, and your dependents. The irs determines which expenses can be reimbursed by an. 6 examples of fsa eligible expenses 1. Expense eligibility is subject to change. You can include medical expenses you paid for your spouse. Fsa eligible expense list health fsa eligible expenses new: Indicating that the claim was for the individual, their spouse, or eligible dependent. Where a physician’s note is required, it must state the precise medical condition. Ineligible expenses contact lens or eyeglass insurance (fsa ineligible only)cosmetic surgery/procedures electrolysis insurance premiums and interest long term care premiums.

Ace bandages acne treatments acupuncture. Contact your employer for details about your company’s fsa, including how to sign up. $24.99 at fsa store the doctor’s nightguard advanced comfort dental protector fsa store there are many people who grind their teeth at night. Unfortunately, insurance premiums are not covered by an fsa. The complete fsa eligibility list.

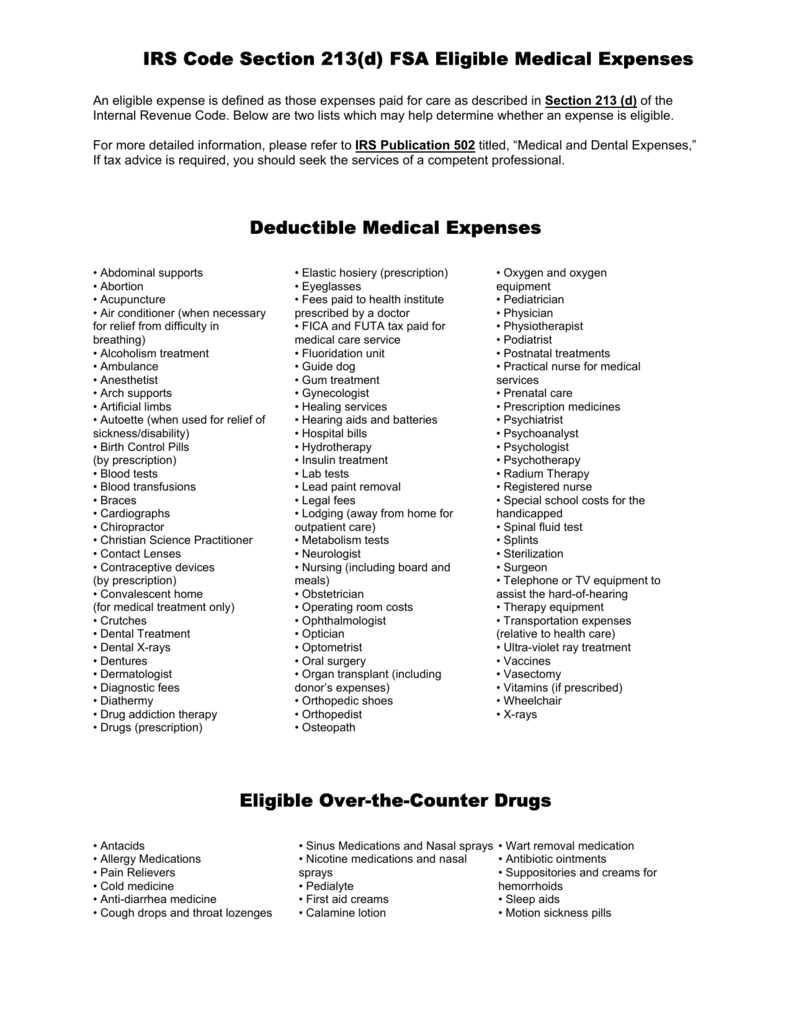

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

An employee who chooses to participate can contribute up to $2,750 through payroll deductions during the 2020 plan year. July, 2021 eligible expenses for the flexible spending accounts (fsafeds) program the internal revenue service (irs) determines what are considered. You can use your health care fsa (hc fsa) funds to pay for a wide variety of health care products and services for you, your spouse, and your.

FLEXIBLE SPENDING ACCOUNTS (FSA) 2020

An employee who chooses to participate can contribute up to $2,750 through payroll deductions during the 2020 plan year. You can use your fsa funds to pay for a variety of expenses for you, your spouse, and your dependents. Where a physician’s note is required, it must state the precise medical condition.

Fsa Fsa List

The irs determines which expenses can be reimbursed by an. You can include medical expenses you paid for your spouse. Expense eligibility is subject to change.

Your Handy List of FSA Eligible Expenses [PDF] Employers Resource

6 examples of fsa eligible expenses 1. Indicating that the claim was for the individual, their spouse, or eligible dependent. The irs determines which expenses can be reimbursed by an.

HSA Expense Eligibility List Campus Services

You can use your fsa funds to pay for a variety of expenses for you, your spouse, and your dependents. You can use your health care fsa (hc fsa) funds to pay for a wide variety of health care products and services for you, your spouse, and your. July, 2021 eligible expenses for the flexible spending accounts (fsafeds) program the internal revenue service (irs) determines what are considered.

HSA Expense Eligibility List Campus Services

6 examples of fsa eligible expenses 1. Indicating that the claim was for the individual, their spouse, or eligible dependent. Ineligible expenses contact lens or eyeglass insurance (fsa ineligible only)cosmetic surgery/procedures electrolysis insurance premiums and interest long term care premiums.

There is still time to spend all your FSA credit. See the list for Eligible FSA Items. www

July, 2021 eligible expenses for the flexible spending accounts (fsafeds) program the internal revenue service (irs) determines what are considered. Unfortunately, insurance premiums are not covered by an fsa. The irs determines which expenses can be reimbursed by an.

2019 FSA and HSA Contribution Limits Stratus.hr®

You can use your fsa funds to pay for a variety of expenses for you, your spouse, and your dependents. Get details from the irs in this publication (pdf, 1.22 mb). Ace bandages acne treatments acupuncture.

Tax Alert IRS Issues 2020 CostofLiving Adjustments Marks

Ineligible expenses contact lens or eyeglass insurance (fsa ineligible only)cosmetic surgery/procedures electrolysis insurance premiums and interest long term care premiums. July, 2021 eligible expenses for the flexible spending accounts (fsafeds) program the internal revenue service (irs) determines what are considered. Includes various items that assist individuals in performing activities of daily living.

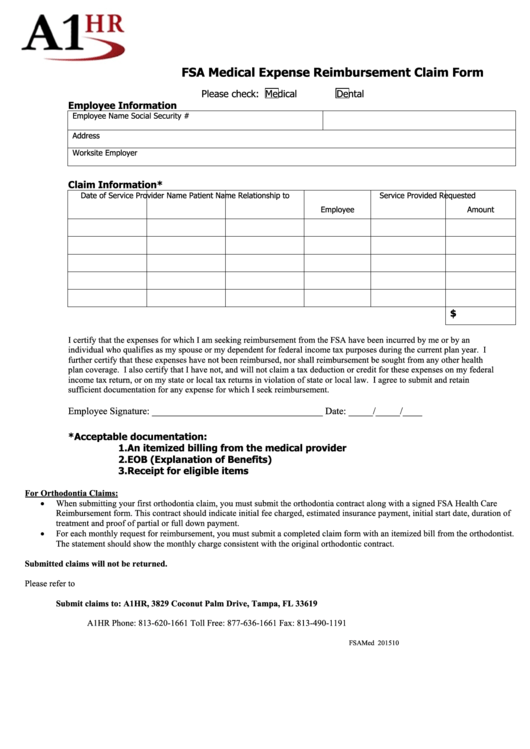

Fillable Fsa Medical Expense Reimbursement Claim Form A1hr printable pdf download

You can use your fsa funds to pay for a variety of expenses for you, your spouse, and your dependents. Includes various items that assist individuals in performing activities of daily living. Contact your employer for details about your company’s fsa, including how to sign up.

To include these expenses, you must have been married either at the time your spouse received the medical. Includes various items that assist individuals in performing activities of daily living. You can use your health care fsa (hc fsa) funds to pay for a wide variety of health care products and services for you, your spouse, and your. Ace bandages acne treatments acupuncture. Where a physician’s note is required, it must state the precise medical condition. You can include medical expenses you paid for your spouse. Ineligible expenses contact lens or eyeglass insurance (fsa ineligible only)cosmetic surgery/procedures electrolysis insurance premiums and interest long term care premiums. Expense eligibility is subject to change. July, 2021 eligible expenses for the flexible spending accounts (fsafeds) program the internal revenue service (irs) determines what are considered. Get details from the irs in this publication (pdf, 1.22 mb).

$24.99 at fsa store the doctor’s nightguard advanced comfort dental protector fsa store there are many people who grind their teeth at night. The irs determines which expenses can be reimbursed by an. Fsa eligible expense list health fsa eligible expenses new: Contact your employer for details about your company’s fsa, including how to sign up. The complete fsa eligibility list. An employee who chooses to participate can contribute up to $2,750 through payroll deductions during the 2020 plan year. 6 examples of fsa eligible expenses 1. Unfortunately, insurance premiums are not covered by an fsa. Indicating that the claim was for the individual, their spouse, or eligible dependent. 16 rows various eligible expenses.

Thus, $2,750 is the limit each employee may make per plan year, regardless of the number of. You can use your fsa funds to pay for a variety of expenses for you, your spouse, and your dependents.

![Your Handy List of FSA Eligible Expenses [PDF] Employers Resource](https://www.employersresource.com/wp-content/uploads/2016/02/FSA-eligible-expenses-feature-image.png)